Your Loan for Anything—Pay off Debt or Fund an Adventure!

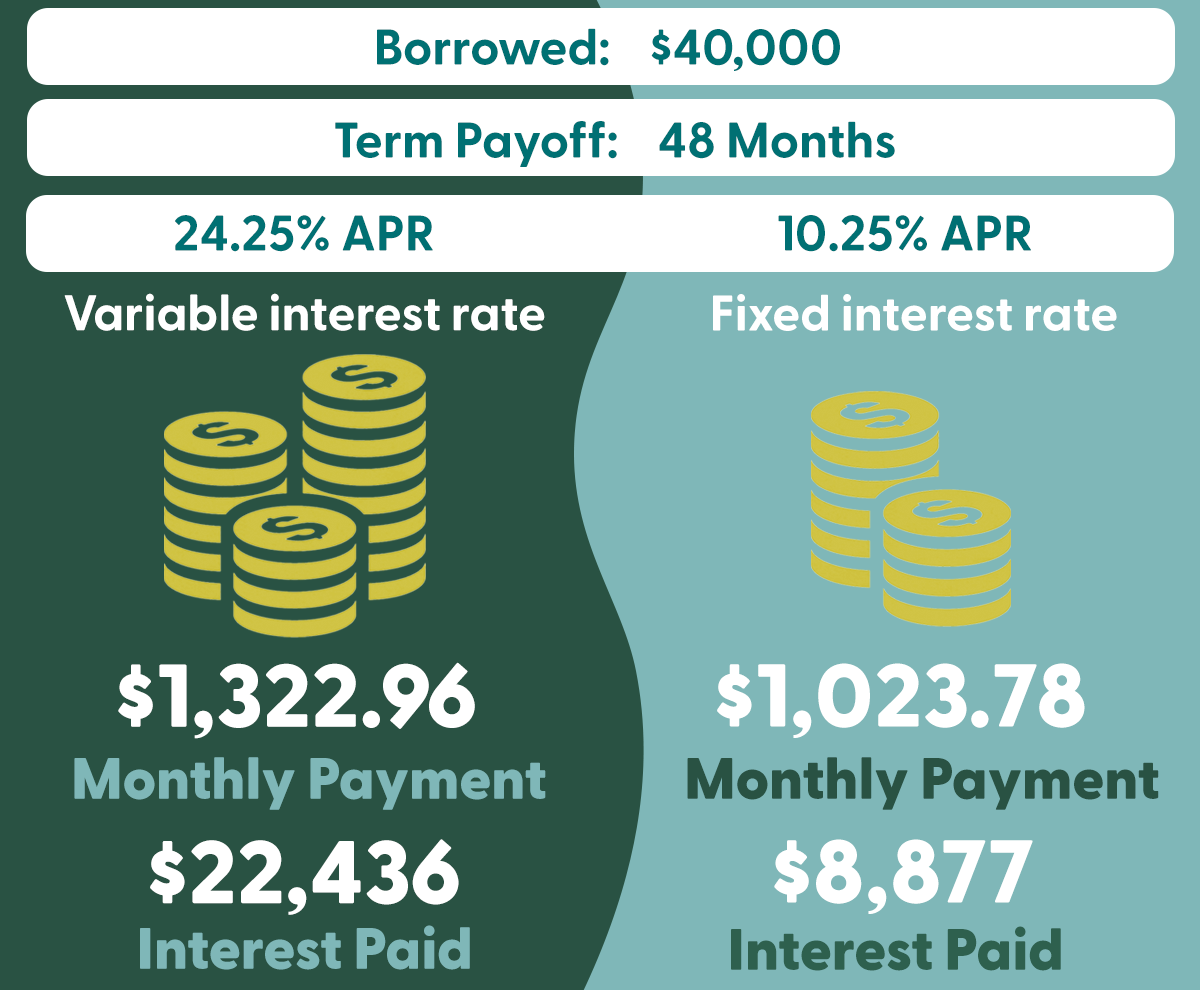

Credit card debt is at record highs, with interest rates often exceeding 20% APR for all credit cards. Store credit cards? The average interest rate is more than 30% APR. Consolidate your payments into one Sandia Area personal loan—with fixed rates starting as low as 10.25% APR.

![]()

$8.38 Million

Debt consolidated by Sandia Area members in 2025.