Your Loan for Anything—Pay off Debt or Fund an Adventure!

Credit card debt is at record highs, with interest rates often exceeding 20% APR. Consolidate your payments into one Sandia Area Personal loan—with fixed rates starting as low as 10.25% APR.

![]()

$1 Trillion

Total credit card debt accumulated by Americans in 2024.

![]()

$9.3 Million

Debt Consolidated by Sandia Area members in 2024.

Lock In A Rate That Won't Change

Say goodbye to unpredictable credit card interest rates, and say hello to one manageable, predictable payment. With a personal loan, lock in a fixed rate as low as 10.25% APR.

Features

- As low as 10.25% APR1 for terms up to 48 months

- As low as 10.75% APR1 for terms from 49 to 60 months

- Borrow up to $40,000

- No application fees

- No transfer fees

- No closing costs

The Benefits of A Personal Loan

Predictable Payments

Pay one monthly payment every month. No guessing, juggling bills, or budgeting for multiple minimum monthly payments. Giving you the flexibility to save for what matters.

![]()

Fixed-Interest Rate

Unlike a credit card, your rate will never change and with a rate as low as 10.25% APR1, you'll save thousands compared to a high-rate credit card.

![]()

Cash for Anything

Use your funds for anything! Consolidate debt, reduce credit your card utilization rate, pay for an event or a trip, or even an education—no collateral required.

Federally insured by the NCUA. An Equal Opportunity Lender. Membership eligibility required. Visit Sandia.org/Membership for complete details. 1. APR = Annual Percentage Rate effective as of 03/26/2025. Rates are subject to change at any time without notice. All loans, terms, and conditions are subject to credit approval. “As low as” rate assumes excellent credit history. Not all applicants will qualify for the lowest rate. All consumer loans are charged simple interest with no pre-payment penalty. 2. For Share Secured Loans, the annual percentage rate will be the current share dividend rate (Index) in effect on deposits of at least $5,000 plus 3.0% (margin). The rate is subject to change monthly on the 1st day of each month to reflect any change to the index.

Term in Months APR1 as low as

48

10.25%

49-60

10.75%

Share Secured2

Learn More

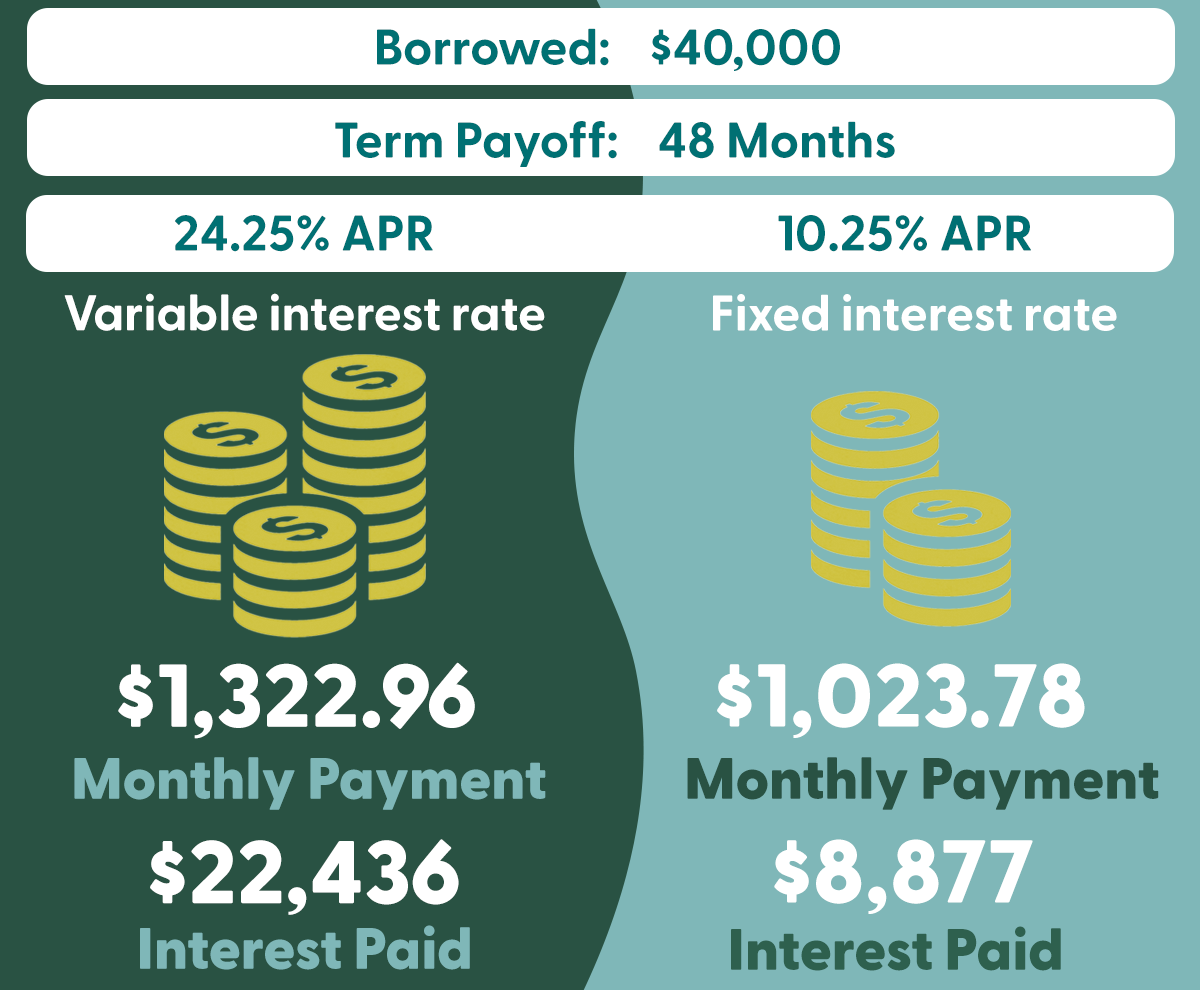

With a fixed rate personal loan, you could save over $13,000 in interest paid* when you combine your variable interest rate debt into one, manageable payment.

*Estimated Variable Interest Rate total interest paid based off of a $40,000 balance with an estimated interest rate of 24.25% APR with a term of 48 months. Estimated Fixed Interest Rate total interest paid based off of a $40,000 balance with an 10.25% APR with a term of 48 months.

What's the process?

Once approved, use your personal loan to consolidate debt, fund an education, or save for what matters

Move forward with one, simple low rate

Simplify Your Debt. Amplify Your Savings.

Calculate the difference our 10.25% fixed rate can make—try the debt consolidation calculator and take the first step toward stress-free finances.

Useful Articles

Loan Payment Example: Estimated monthly payment of $995.22 for 48 months with a loan amount of $40,000 at 8.99% APR.

Go to main navigation