Home Equity Installment Loans

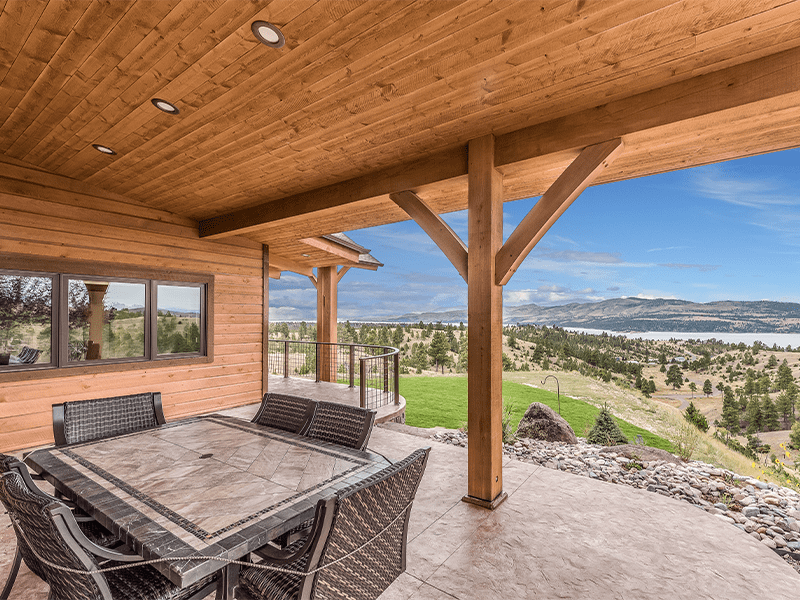

Use the value in your home to build your dreams with a home equity installment loan!

With a fixed-rate home equity installment loan, your funds are dispersed in a lump-sum with predictable payments—perfect for major projects, debt consolidation, and other one-time expenses.

Features

Rates as Low as 6.75% APR1

Fixed rates mean predictable payments, making it easier to factor into your budget.

No Closing Costs

Depending on the county your property is located in, you may qualify for no closing costs, saving you thousands.2

No Application Fees or Annual Fees

It’s simple to apply for a Sandia Area home equity loan.

Use Funds for Anything

Use your home equity loan to build anything—a deck, a kitchen, your credit, or even a future.

Home Equity Installment Loan Rates

Effective Date: 03/12/2025

| Term in Months | APR1 as low as |

|---|---|

| 120 | 6.75% |

| 180 | 7.00% |

| Federally insured by NCUA. An Equal Opportunity Lender. 1. APR=Annual Percentage Rate. Rate effective 03/12/2025, and subject to change without notice. New Sandia Area loans only. Subject to credit approval. Rates are based on an evaluation of credit history and lien position. “As low as” rate assumes excellent credit history and first lien position. Your rate may differ. 2. Closing costs associated with this product are waived for loan amounts up to $150,000 in the counties of Bernalillo, Sandoval, Santa Fe, Valencia, Torrance, Cibola, Dona Ana, Rio Arriba, Mora, San Miguel and Los Alamos on residences with clean title history. Loans over $150,000 are subject to property appraisal, flood certification, recording fees and title insurance, which generally range from $1,467 to $1,600. Borrower is responsible for homeowners’ insurance and, if required, flood insurance. | |

Ready to get started?

Forms Required